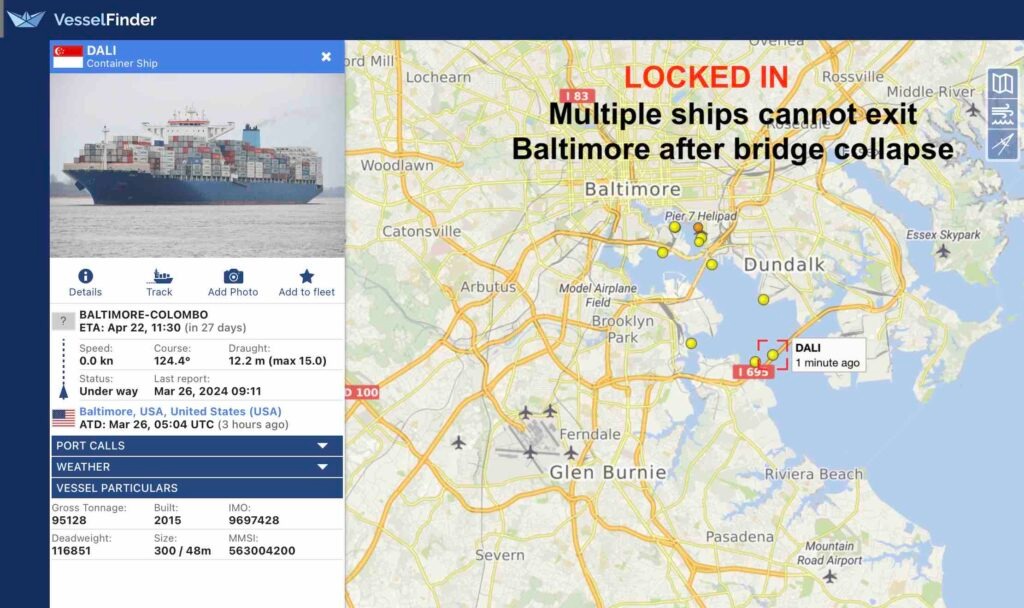

Shipping through Suez Canal Impacted

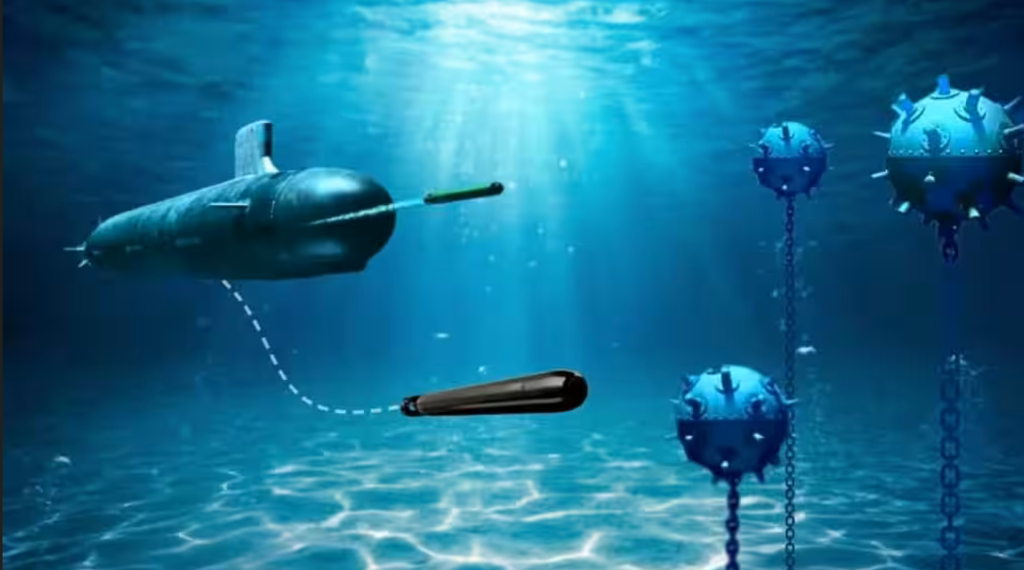

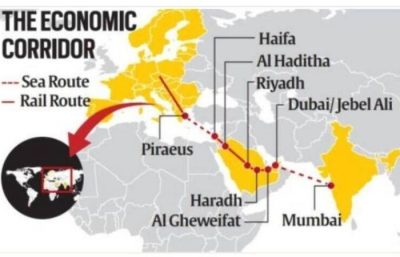

Global supply chain woes continue. Earlier, drought hampered shipping through Panama Canal. Now, transit through Suez Canal (12% of world trade) is impacted due to rising threat levels in Red Sea.

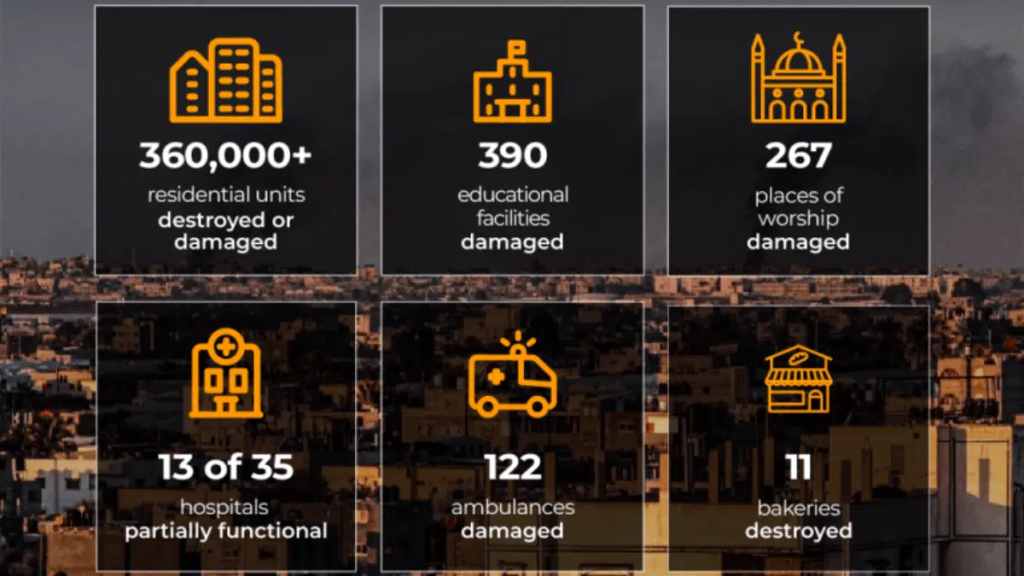

Iran-backed Houthis, in control of North Yemen, have targeted ships using drones & missiles since Israeli offensive in Gaza. According to New York Times, “The wave of attacks against merchant ships in Red Sea is forcing companies to send ships on the longer routes and threatens to hurt an already wobbly global economy.” About 50 vessels use Suez Canal a day. As of Monday, at least 32 had been diverted, says S&P Global Market Intelligence.

BP, Maersk, Hapag-Lloyd & MSC have decided not to use Red Sea over the past week. According to Atlantic Council, seven out of the 10 biggest shipping companies have suspended operations in Red Sea.

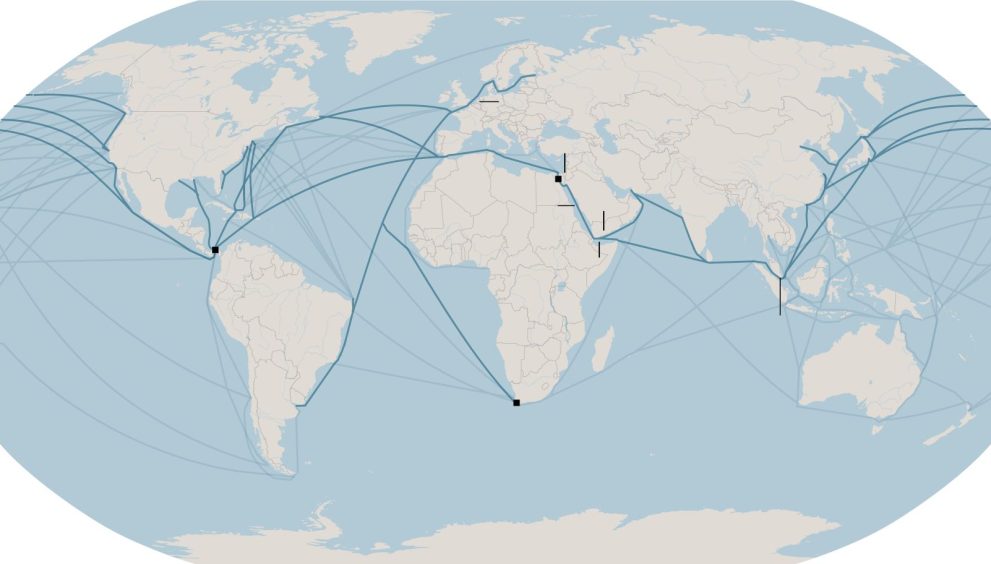

“Re-routing adds cost & time to vessel journeys. Oil prices and war risk insurance premiums have spiked as a result,” says Reuters. The 120-mile Suez Canal is the shortest sea route between Asia & Europe & one of seven geographic choke points critically important to world oil trade.

Shipping companies have a binary choice: face the risk of travelling through the Red Sea and rising insurance costs that brings – or divert their vessels. Rerouting via Cape of Good Hope adds 40% (or 3,300 miles) distance from Singapore to Rotterdam and nearly $1 million per round shipping from Asia to Europe in cost.

Insurance risk premiums are rising – from 0.07% of value of a ship at the start of Dec to 0.5 – 0.7% in recent days. Shipping costs are 20% up. Additional cost passed on to consumers could lead to inflation in the US & Europe. Oil prices have risen 8% over the last week in spite of subdued demand.

Despite the formation of the US-led OPG, it is not clear when commercial shipping groups will feel confident enough to allow their vessels to pass through the Bab el-Mandeb Strait again. The U.S. warship on Saturday brought down 14 drones launched from Houthi-controlled territory.

Some organisations confirmed their shipments are facing delays. Many have informed stakeholders & exploring aerial transportation of emergency cargo.

Expert views would be welcome on “what measures should be taken to mitigate supply chain risks.”

Disclaimer: The article has reference to open sources including Reuters, New York Times, S&P Global & Atlantic Council.

Samrendra Mohan Kumar Pawan Desai Sushil Pradhan Sandeep Shrivastava Ranjeet Sinha Aparna Guddad Kunal Solanki Inder Chaudhry Sagar Bhanushali 🇮🇳

Member Login

Member Login