Ten Ways How Gig Workforce Can Contribute To “Surakshit Bharat Abhiyan”

SURAKSHIT BHARAT ABHIYAN, IMPACT AND BENEFITS TO GIG WORK FROCE AND GIG ECONOMY by Satyajit Roy for Securityskillsworld.com

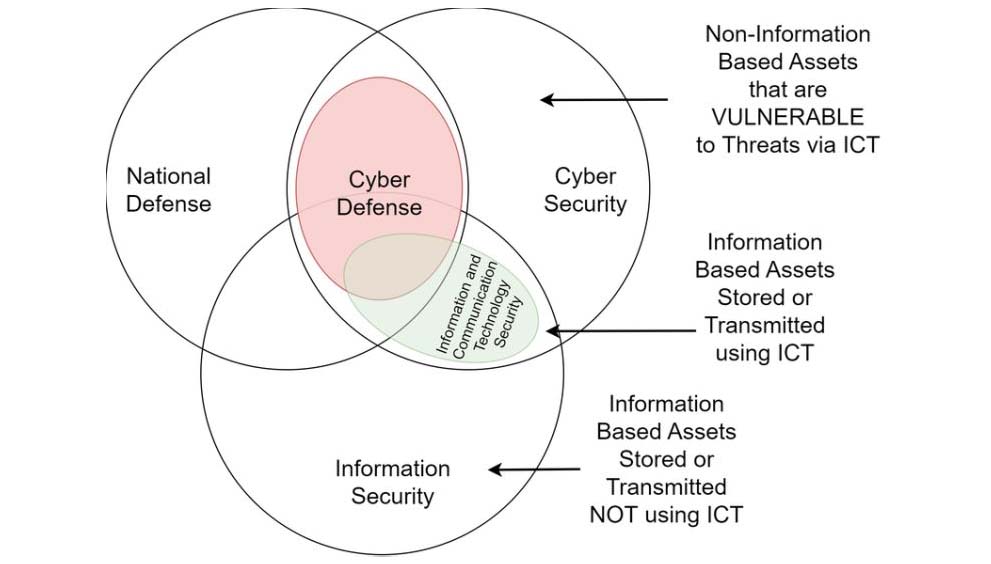

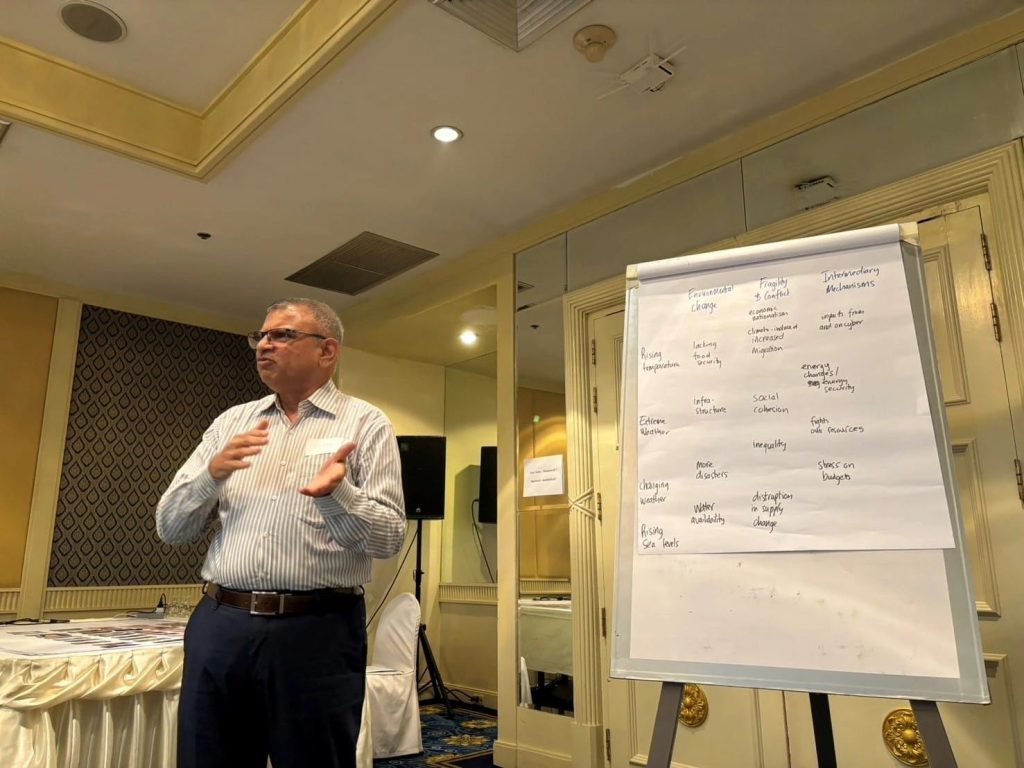

Concepts

- Security And Loss Prevention Consciousness India

- Security And Loss Prevention Framework, India

- Gross Domestic Loss Prevention (GDLP) Index as the Alter Ego of Gross Domestic Production (GDP) Index of Bharat

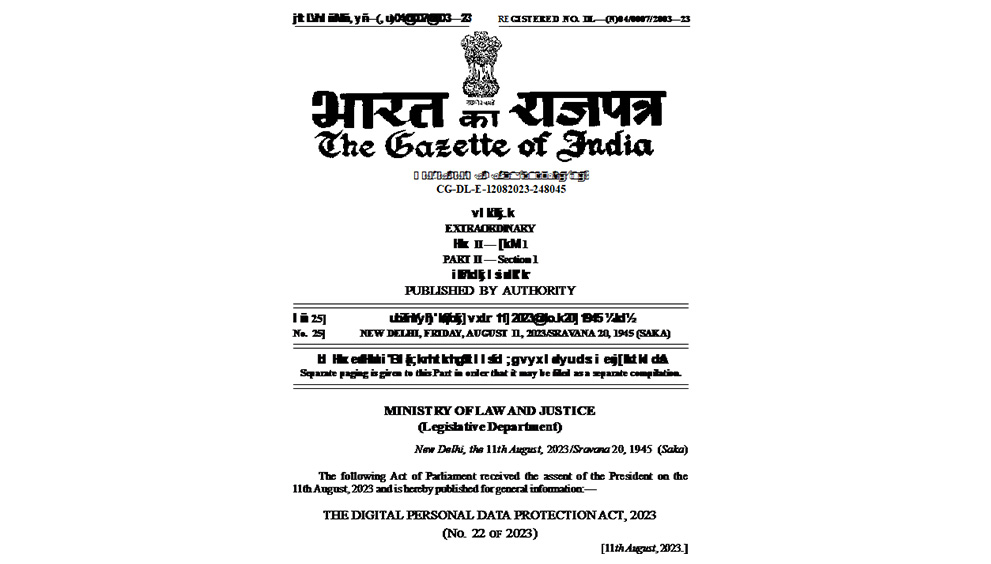

“Government Working on Welfare and Social Security Benefits for Gig Workers”. Recent announcements by Shri Mansukh Mandaviya Ji, the Hon. Union Minister for Labour and Employment, indicate that the government is exploring various avenues to ensure gig workers are covered under social security schemes. The Indian government has been actively working on extending social security an welfare benefits to gig and platform workers, recognising their growing role in the economy.

Shri Mandaviya emphasized that the inclusion of gig workers under the Code on Social Security, 2020, is a landmark development, as it officially defines and recognizes gig and platform workers in India for the first time. This move is aimed at developing a comprehensive framework that ensures adequate protection for these workers, aligning with the evolving nature of work in the digital age

The government’s future plans include working closely with stakeholders to implement robust social security measures. This includes pension, insurance, and other welfare schemes tailored for the needs of gig workers. As the gig economy continues to expand, these measures are seen as critical to supporting this workforce’s welfare and economic stability in the long run.

|

Gig Workforce and national Security

Gig economy workers can play a pivotal role in the ‘Surakshit Bharat Abhiyan’ (Safe India Campaign) by contributing to security consciousness and loss prevention across various sectors. This participation can help drive GDP expansion by mitigating risks, reducing losses, and improving safety measures. Here are several ways gig workers and the gig economy can actively participate:

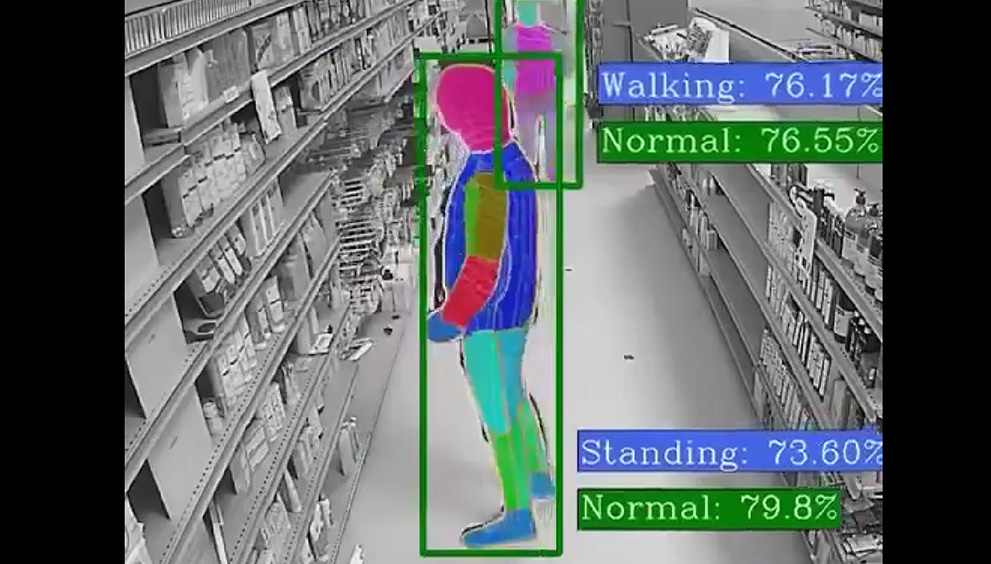

1. Leveraging Gig Workers for Data Collection and Analysis:

Gig workers can assist in gathering data on local risk factors that contribute to losses in different industries. Their widespread presence across various sectors (e.g., food delivery, transportation, and logistics) makes them valuable in detecting security issues like theft, accidents, or unsafe practices.

- Real-time Reporting: Delivery personnel and rideshare drivers can report incidents or unsafe conditions through mobile apps, feeding data into a national database to identify trends and improve safety protocols.

- Predictive Analytics: Gig workers with data and tech skills can help analyze this data, creating predictive models for businesses and local governments to anticipate and prevent risks, contributing to loss prevention.

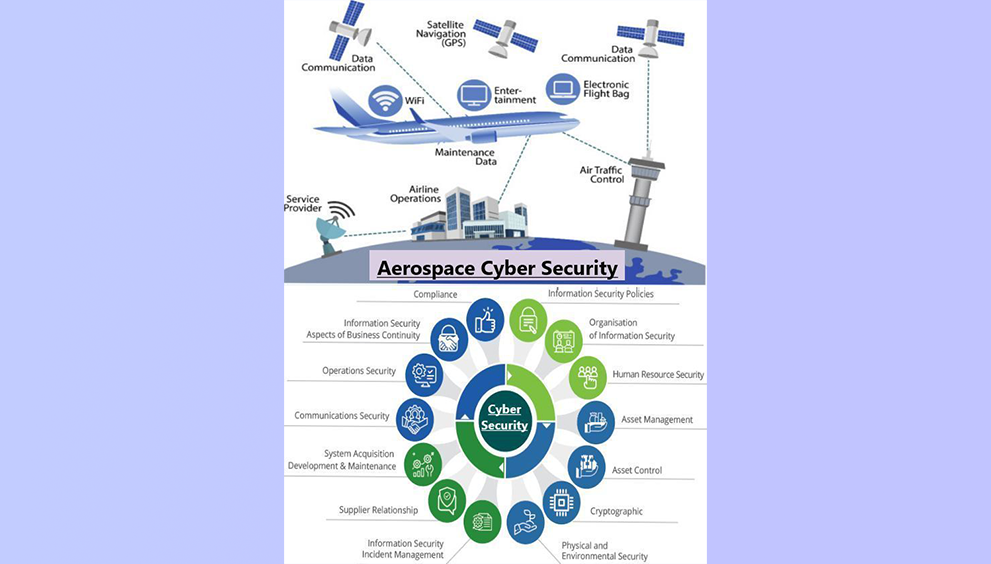

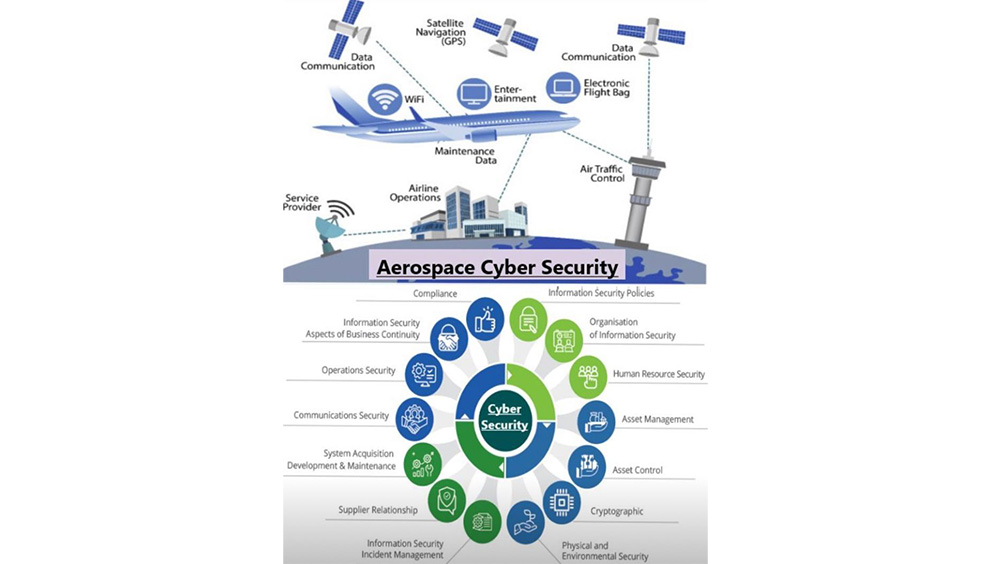

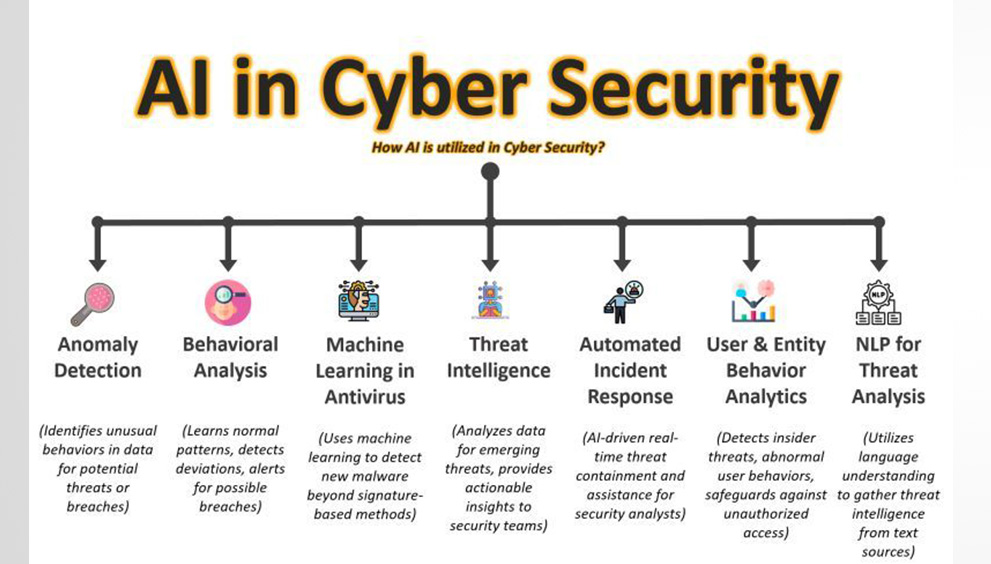

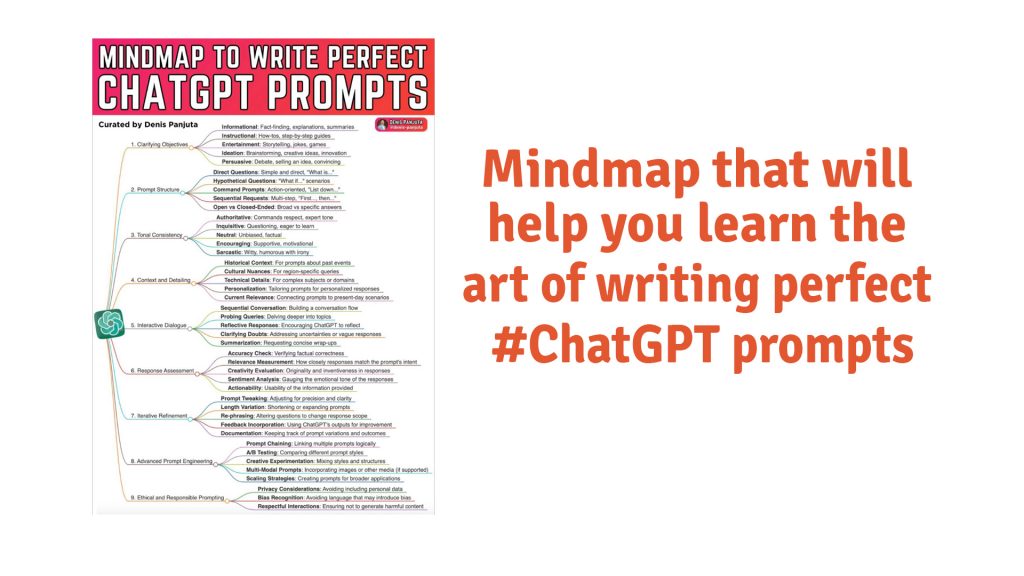

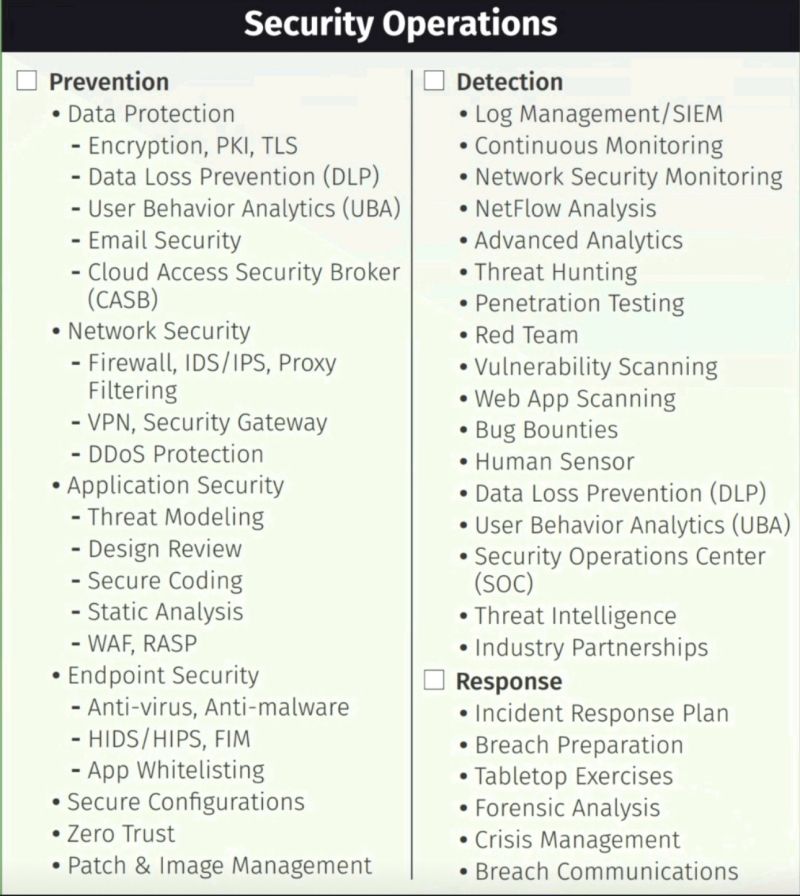

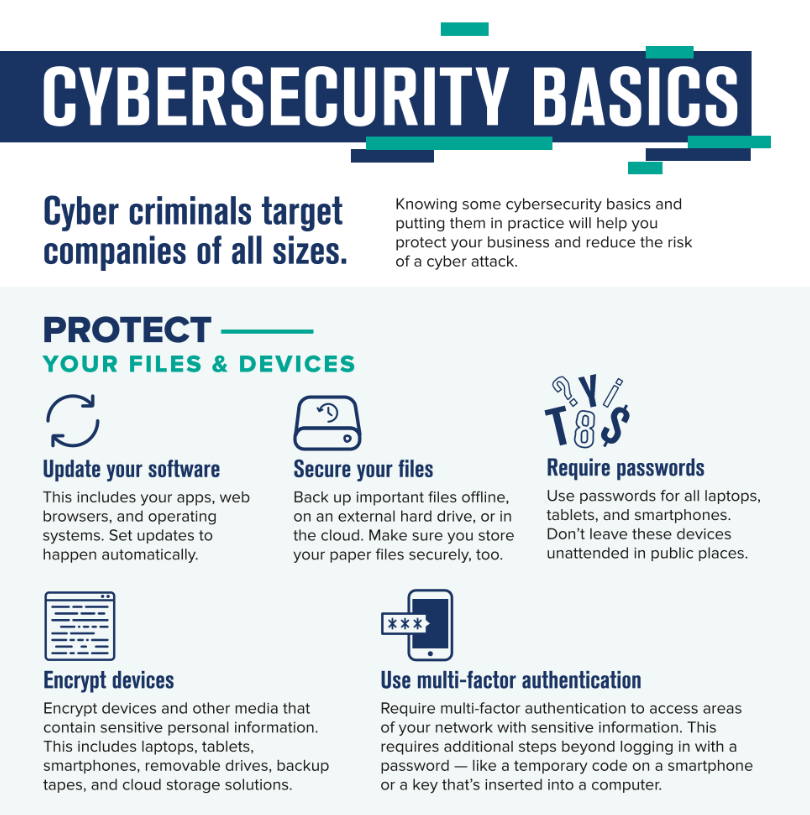

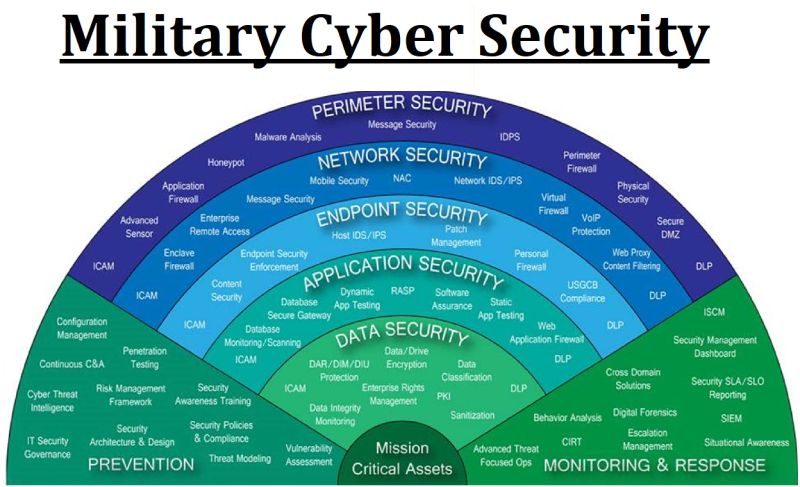

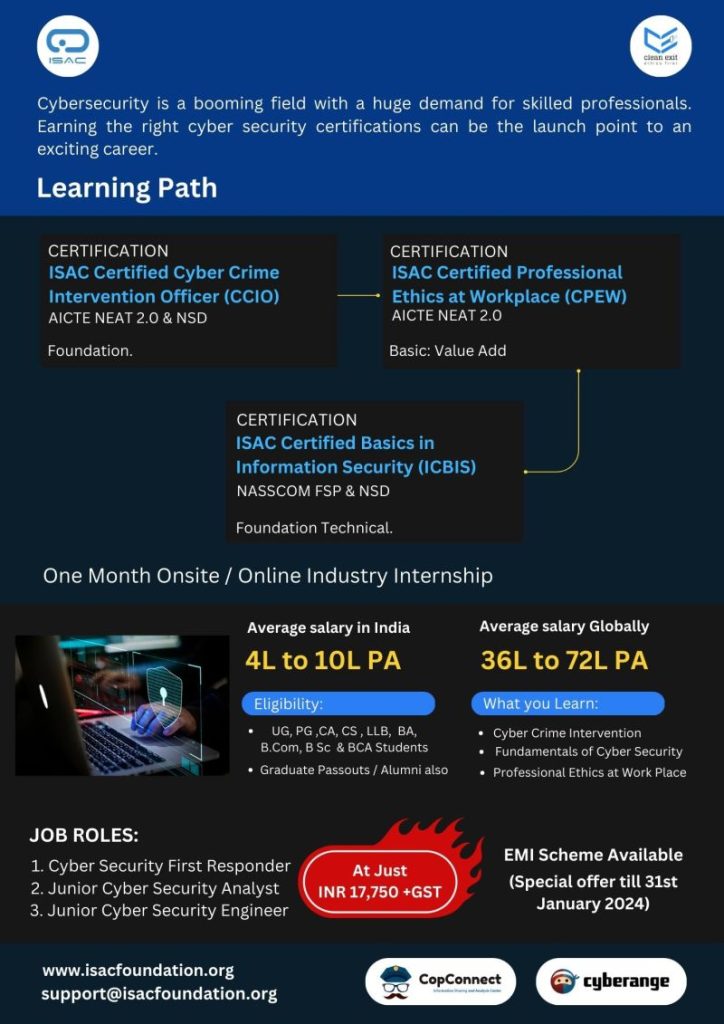

2. Promoting Cybersecurity Awareness:

Many gig workers operate online platforms or freelance in tech-related roles. They can contribute to cybersecurity awareness by:

- Conducting digital hygiene workshops and spreading awareness about online frauds and phishing scams, especially for small businesses and vulnerable users.

- Reporting cybersecurity breaches or anomalies in digital payment systems, which is critical in India’s growing digital economy where online fraud could lead to significant financial loss.

- Building and managing systems that improve the resilience of businesses and communities against cyber threats, which can prevent significant economic losses.

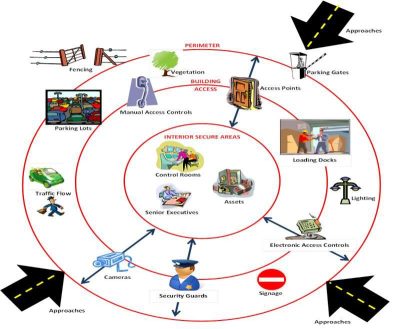

3. Community Watch and Local Surveillance:

Gig workers, especially those in ride-hailing and delivery services, are frequently in neighborhoods and communities. Their constant mobility can contribute to local safety by:

- Acting as community watchers to observe and report suspicious activities. For instance, delivery personnel can be trained to recognize signs of theft or vandalism and alert authorities through apps or helplines.

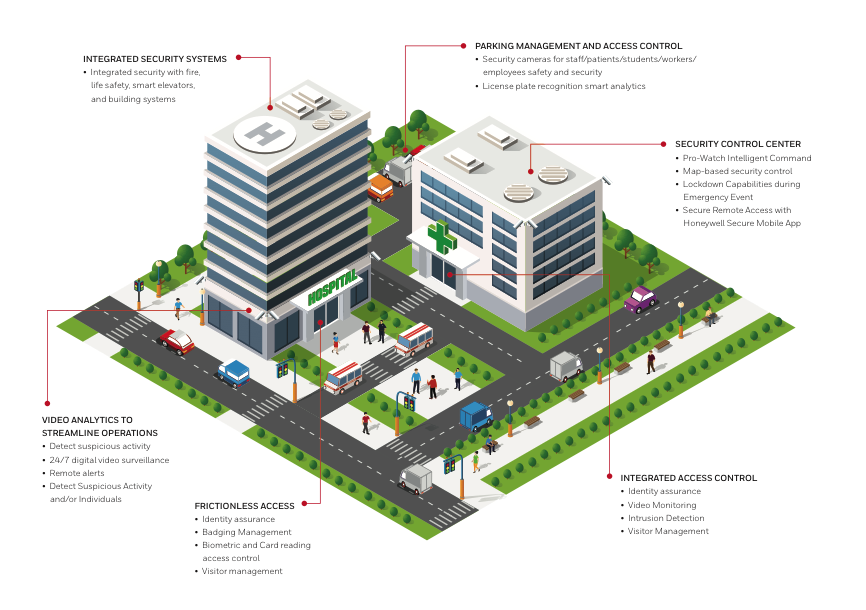

- Assisting in the implementation of loss prevention technologies like IoT-based surveillance systems in local businesses and residential areas.

- Encouraging the adoption of safety protocols and helping spread awareness about the need for secure neighborhoods and workplaces.

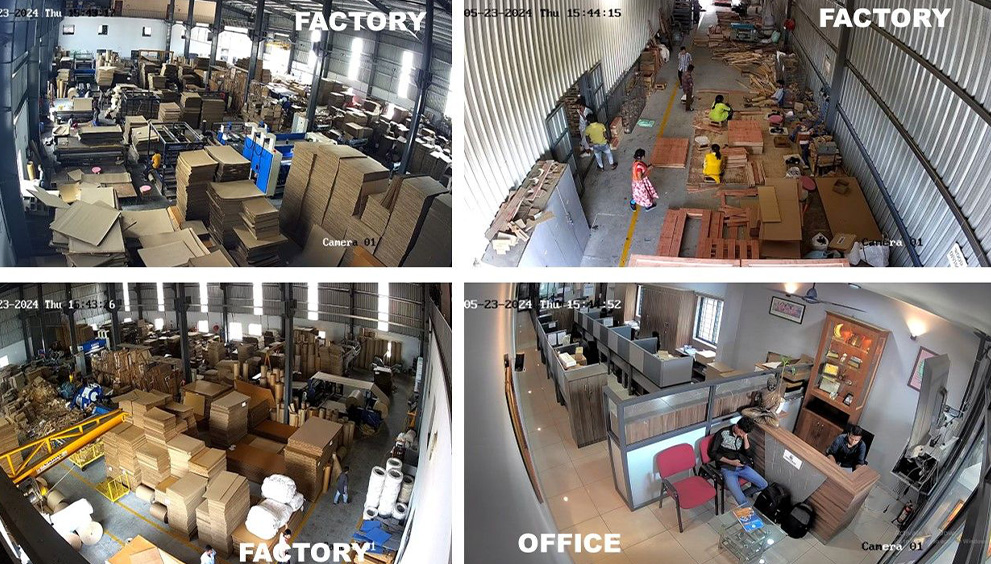

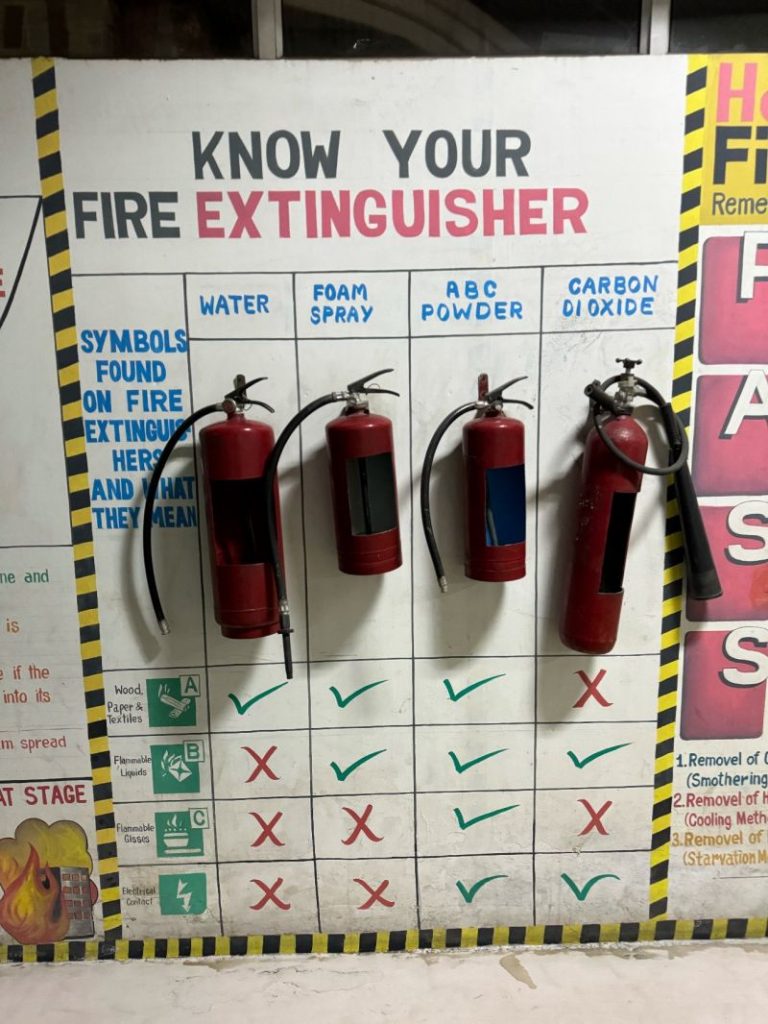

4. Strengthening Workplace Safety in Construction and Logistics:

Gig workers in construction, manufacturing, and logistics can be mobilized to prevent on-site accidents, which are a major source of financial and human capital loss:

- Safety Audits: Gig workers with specialized skills can participate in conducting safety audits and compliance checks at construction sites and factories, ensuring adherence to safety standards.

- Promoting the use of safety equipment and providing first-hand feedback on hazardous conditions in the workplace can help prevent occupational hazards, thus reducing healthcare and compensation costs.

5. Enhancing Loss Prevention in E-Commerce and Retail:

Gig workers in e-commerce and retail sectors, such as delivery personnel and warehouse staff, can help prevent losses through:

- Inventory Tracking: Using their daily interaction with goods in warehouses and during deliveries, gig workers can help track inventory discrepancies and report theft, damaged goods, or stock mismanagement.

- Last-Mile Delivery Security: Gig workers involved in the last-mile delivery process can enhance package security and identify suspicious behavior that may lead to package theft or loss, ensuring secure delivery services.

6. Disaster Response and Recovery Operations:

Gig workers can be an essential part of local disaster response efforts by supporting communities during natural calamities or crises:

- Providing on-the-ground intelligence on affected areas to government authorities, aiding in faster deployment of relief operations.

- Delivering essential supplies in emergencies, such as during floods, earthquakes, or pandemics, while also helping businesses safeguard their assets and ensure quick recovery.

7. Gig Workers in the Financial Sector – Fraud Prevention:

Freelancers and gig workers in the financial services sector (such as fintech, digital wallets, etc.) can contribute by monitoring and preventing financial fraud:

- Implementing real-time fraud detection mechanisms, particularly in digital transactions, to reduce the growing threat of financial scams.

- Providing consultancy to businesses on loss prevention strategies in financial operations.

8. Awareness Campaigns and Training:

Gig workers can actively engage in spreading awareness campaigns for the ‘Surakshit Bharat Abhiyan’ and educating communities on the importance of loss prevention:

- Conducting workshops or virtual sessions on safety, security, and loss prevention, especially targeting small businesses, local vendors, and individuals unfamiliar with these practices.

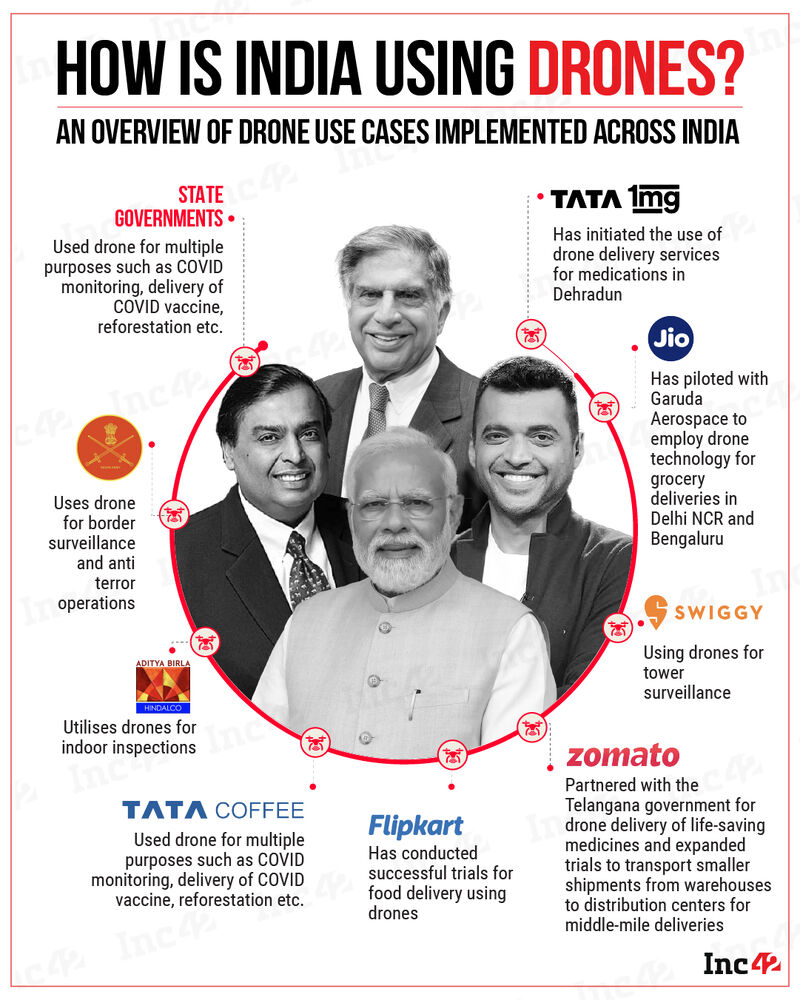

- Collaborating with corporate social responsibility (CSR) initiatives of large platforms like Uber, Ola, or Zomato to promote security awareness and training programs across regions.

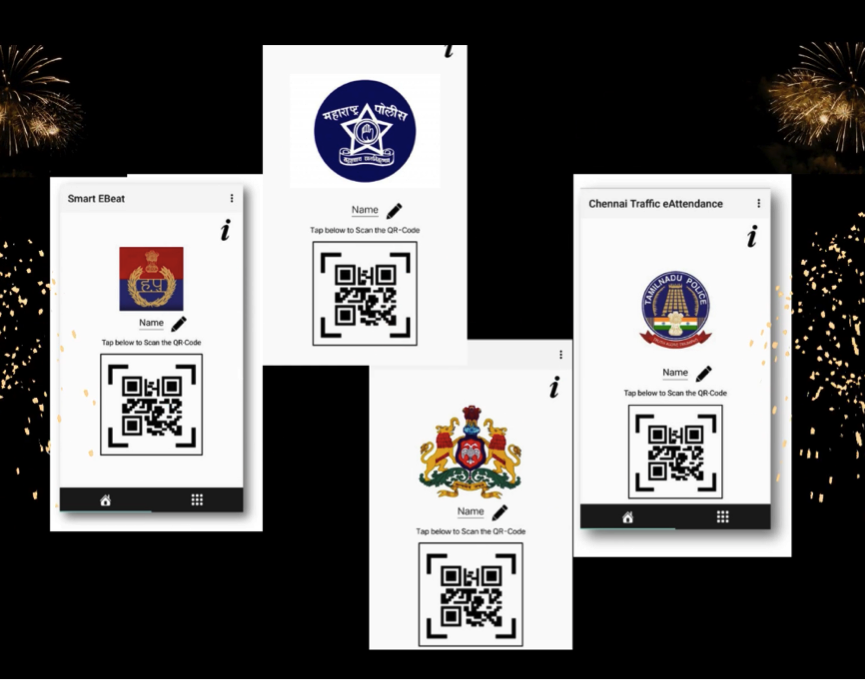

9. Technology Integration for Security and Safety:

Tech-savvy gig workers can help integrate technology-based solutions in various sectors to reduce risks and losses:

- Implementing AI-driven surveillance and risk detection systems in businesses and communities.

- Building apps or platforms for real-time monitoring of security incidents and assisting businesses in adopting such tech-driven security measures.

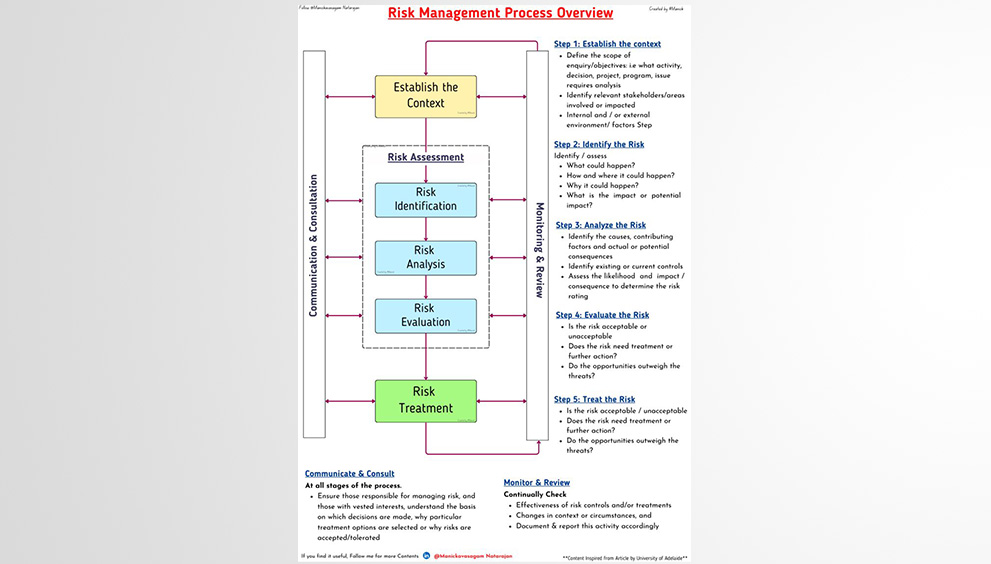

10. Financial Literacy and Risk Management:

Gig workers with expertise in finance can help in financial literacy programs aimed at businesses and individuals, ensuring better risk management and security practices:

- Teaching small businesses how to protect assets, manage debts, and mitigate risks that lead to financial losses.

- Encouraging the adoption of insurance policies and other financial tools to secure assets and business operations, minimizing the impact of unforeseen events.

Key Figures and Financial Implications:

The gig economy in India has experienced exponential growth, fueled by the rise of digital platforms that connect workers with on-demand jobs. As of 2024, India’s gig workforce is estimated to be around 7.7 million workers, accounting for approximately 1.5% of the total workforce. This number is expected to increase to 23.5 million by 2030, contributing significantly to the country’s labor market. The gig economy spans various sectors, including ride-hailing, food delivery, e-commerce, and freelance services such as tech and creative roles.

- Size of the Gig Economy:

- The gig economy in India contributes approximately $47 billion to the country’s Gross Domestic Product (GDP), according to NITI Aayog’s estimates. This contribution is expected to rise with the expansion of digital platforms and the increased reliance on gig workers by companies in logistics, transportation, and e-commerce.

- By 2030, the gig economy is projected to account for 4-5% of India’s GDP.

- Projected Workforce Growth:

- A report by Boston Consulting Group (BCG) estimates that India’s gig economy will employ 90 million workers by 2030, representing nearly 30% of the non-farm workforce.

- The NITI Aayog report further indicates that 55% of gig workers are employed in medium-skilled jobs, while 35% are in low-skilled jobs such as delivery or driving, and 10% are in high-skilled jobs like freelance tech or creative roles.

- Platform Companies:

- Popular gig platforms such as Ola, Uber, Swiggy, Zomato, and Urban Company employ millions of workers. For example, Swiggy and Zomato collectively have over 500,000 delivery personnel on their platforms, while Uber and Ola have employed a similar number of drivers.

- Urban Company, a gig platform for home services, has around 30,000 workers offering services such as cleaning, beauty, and plumbing.

- Income and Earnings:

- The earnings of gig workers vary significantly based on the type of job and location. In general, low-skilled gig workers in urban areas (e.g., delivery drivers or rideshare drivers) earn around ₹15,000 to ₹25,000 ($180 to $300) per month.

- High-skilled gig workers, such as freelance software developers or content creators, can earn between ₹50,000 to ₹100,000 ($600 to $1,200) per month, depending on their projects.

- Financial Implications of Welfare Schemes:

- The inclusion of gig workers under the Code on Social Security, 2020, will require a financial contribution from platforms and the government. Platform companies may be required to contribute 1-2% of their revenue towards a social security fund for gig workers.

- A significant portion of gig workers, estimated at 40%, currently lack any form of social security or insurance. Extending benefits such as health insurance, life insurance, and pensions will cost the government and aggregators approximately ₹2,000 to ₹5,000 crore annually ($240 to $600 million).

- The e-Shram portal, which registers unorganized workers, including gig workers, has already seen the enrollment of over 28 crore workers, though a more granular breakdown of gig workers within this figure is still evolving.

- Digital Payments and Financial Inclusion:

- The increased use of digital payments and fintech solutions has enabled better financial inclusion for gig workers, many of whom were previously part of the unbanked population. Platforms now pay workers directly to their bank accounts, reducing dependency on cash-based payments.

- The rise of neobanks and fintech companies in India is helping gig workers access loans, insurance, and savings products tailored to their specific needs, improving their financial resilience.

Challenges and Future Implications:

- Income Volatility: One of the main challenges for gig workers is the unpredictability of their income, as it is often based on demand, task completion, and fluctuating platform policies. This financial instability has highlighted the urgent need for a universal social security net.

- Platform Responsibility: Gig platforms will need to adjust their business models to accommodate government-mandated social security contributions. This could lead to increased operational costs for platforms, potentially influencing service pricing or gig worker compensation.

- Impact on Taxation: Gig workers, who often work as independent contractors, may face complex tax regulations. Clarifying their tax status and offering tax benefits could help reduce financial pressure on this workforce segment.

The gig economy in India is rapidly expanding, with millions of workers and a growing share of the nation’s GDP coming from gig-based jobs. However, the financial implications of integrating gig workers into the country’s social security system are significant. While welfare schemes and social security frameworks will benefit gig workers in the long term, the challenge will be ensuring smooth implementation, platform participation, and sufficient financial backing. With the right reforms, India’s gig economy has the potential to contribute robustly to economic growth while offering a more secure livelihood for millions.

The content herein is based on open source information, data, news, images etc; OSINT research and analysis to the extent possible is conducted, however, no validation or authentication on any count is claimed. The author indemnifies himself of any or all editorial risk and responsibilities whatsoever. While every effort has been made to ensure the accuracy and reliability of the information, the author assumes no responsibility for any errors, omissions, or consequences resulting from the use of this material

Member Login

Member Login