TURBOPROP REVIVAL: INDIA’S SKY-HIGH INTEREST SPARKS A ‘PROPELLING’ MARKET SURGE

by Vaibhav Agrawal

History has demonstrated the perils of deploying ill-suited aircraft on regional routes, which can severely undermine an airline’s viability. In this context, the 40-seat capacity of turboprops like the D328eco aligns well with India’s burgeoning regional aviation needs.

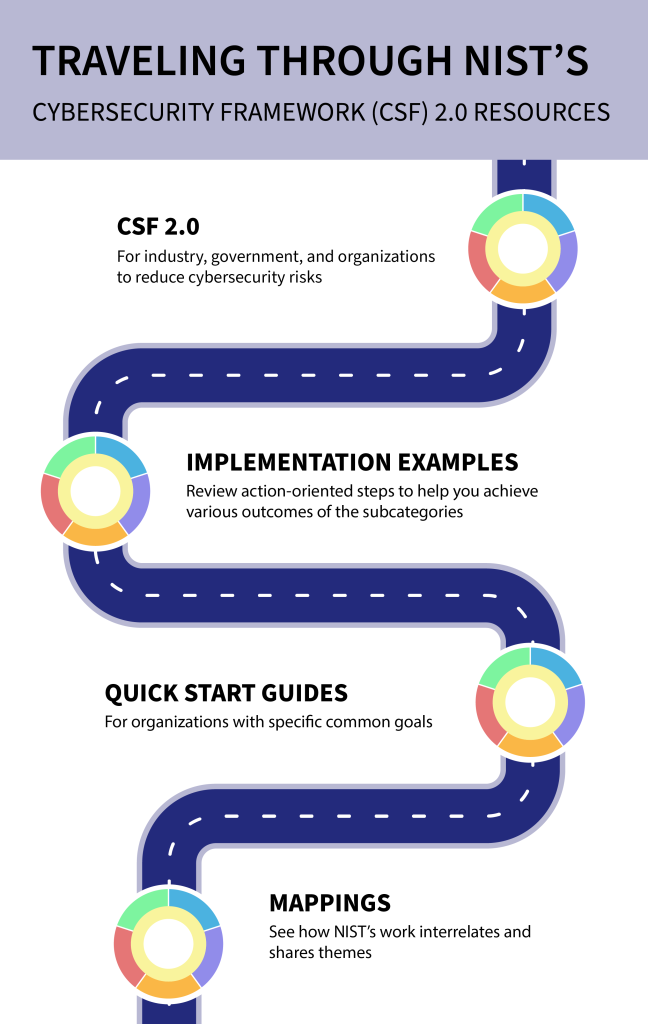

While there are periodic proclamations that turboprop aircraft are becoming outdated and nonviable options, this class of planes continues to carve out its niche in the market for 90 seats or fewer. Turboprops persist not just as ageing workhorses soldiering on, but also in the form of modern aircraft outfitted with cutting-edge avionics, enhanced specifications, and fuel-efficient designs that render them attractively profitable ventures.

One particularly intriguing development is the advent of hybrid hydrogen turboprops that harness eight-bladed propellers powered by emissions-free systems. These environmentally friendly powerplants have piqued significant interest within the industry. Concurrently, Embraer is actively developing a turboprop prototype, a project in which India has expressed interest in collaborating.

The Dornier328eco: A Modern Turboprop Entrant

Among the latest entrants to this market segment is the Dornier328eco, a 40-seat aircraft backed by the American aerospace contractor Sierra Nevada Corporation (a partner in NASA’s Dream Chaser space plane program) and subsidized by German state funding. This revamped iteration of the venerable Dornier 228 and 328 aircraft families is slated to become available in 2025, having already secured its launch customer in the aviation firm Private Wings.

Deutsche Aircraft exudes confidence that the D328eco turboprop is poised for success in the market. The company enthusiastically endorses the aircraft’s merits, stating: “We are ready to transform the way the world travels with our new-generation turboprop aircraft. By introducing advanced flight deck capabilities, a sustainable aviation fuel-compatible airframe, and more efficient engines, the D328eco will reduce our carbon footprint and revolutionize the way we fly.”

This updated model features a fuselage extended by 2.10 meters, enabling it to accommodate ten additional passengers compared to the base model, bringing the total capacity to 43. Furthermore, it will be equipped with new engines and a state-of-the-art avionics suite, enhancing its performance and operational capabilities.

When it comes to regional air travel, India emerges as a prime market for such aircraft. This environmentally friendly iteration of the 328, with its emission-reducing power plants, could find favour among nations like India that prioritise sustainable aviation solutions.

Deutsche Aircraft’s D328eco represents a compelling offering, combining increased passenger capacity, advanced avionics, and fuel-efficient engines with a sustainable aviation fuel-compatible airframe. These attributes position the aircraft as a potential game-changer in regional air travel, particularly in markets like India, where environmental consciousness and operational efficiency are paramount considerations.

India’s Growing Regional Aviation Market

A major tailwind for turboprop aircraft like the D328eco in India comes from the government’s concerted efforts to boost the aviation sector. Initiatives like the Regional Connectivity Scheme (RCS) and the UDAN (Ude Desh ka Aam Naagrik) scheme aim to develop new airports, upgrade existing ones, increase regional connectivity, and make air travel more accessible to people in remote and underserved areas.

The Indian government has an ambitious target of operationalising 1000 UDAN routes during the currency of these schemes, a significant increase from the current 517 routes across 76 airports.

A key aspect that requires attention is building a dedicated turboprop fleet tailored for regional operations. According to turboprop manufacturer ATR, the global demand for turboprops is projected to reach around 2,450 aircraft over the next 20 years, with aircraft replacement driving demand for 1,500 new aircraft by 2041. India emerges as an attractive market, especially if manufacturers opt to assemble these planes domestically.

History has demonstrated the perils of deploying ill-suited aircraft on regional routes, which can severely undermine an airline’s viability. In this context, the 40-seat capacity of turboprops like the D328eco aligns well with India’s burgeoning regional aviation needs.

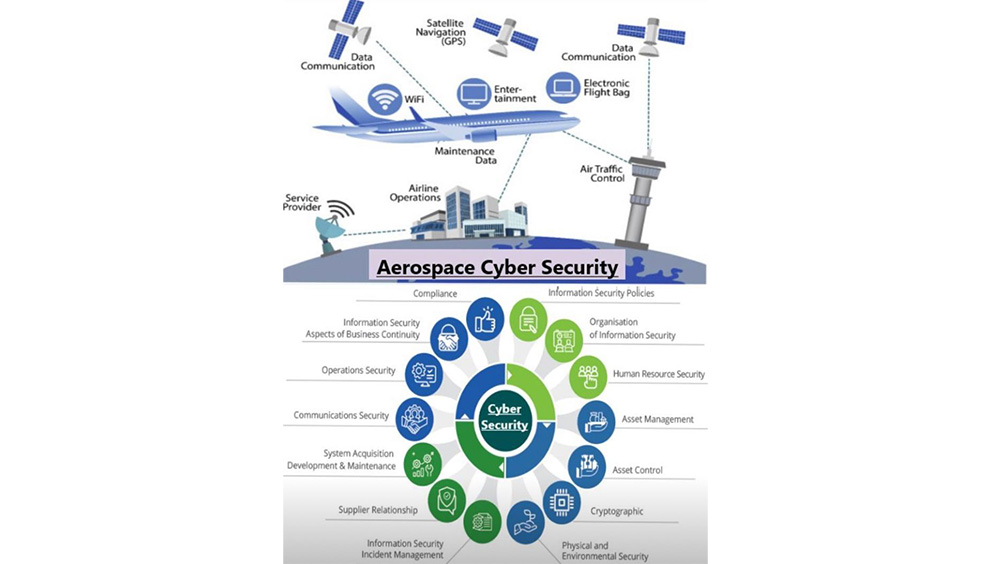

India has made strategic investments in modernizing its air traffic control systems, aimed at enhancing safety and operational efficiency as its aviation sector expands. With an increasing number of town pairings coming into the regional connectivity landscape, low-capacity but higher-frequency turboprop connections are primed to form a robust network across the country.

ATR, a major turboprop manufacturer, makes a compelling case for the future relevance of these aircraft. As fuel prices rise and carbon taxation looms, combined with growing passenger demand for lower-emission travel options, the aviation industry will naturally gravitate towards low-carbon-emitting aircraft such as turboprops. This environmental consideration could well be a factor influencing India’s civil aviation minister, Jyotiraditya Scindia’s strategic thinking.

Regional carriers like Alliance Air, FlyBig, Star Air, and the newly launched Fly-91 are expected to find turboprops as a viable and economical option for their operations. Alliance Air, having already established an ATR turboprop fleet, is demonstrating the successful utilization of these aircraft in India’s regional markets.

The ATR 42-600, in particular, emerges as a frontrunner for regional operations. With its smaller capacity and low trip costs, this turboprop model is perfectly suited for initiating, developing, and sustaining regional routes while delivering optimal economics. Moreover, its strong commonalities with the larger ATR 72-600 provide operators with the flexibility to match capacity with demand across their networks.

The turboprop aircraft market is poised for a significant surge in demand. Raul Villaron, Asia Pacific Vice President for Embraer Commercial Aviation, forecasts that “the Asia Pacific region, including China, requires more than 3000 aircraft under 150 seats in the next 20 years.” He highlights that crossover jets like Embraer’s E-Jets E2 and the first-generation E-Jets play an essential role, while the company is also taking the lead in reviving the turboprop segment by planning an aircraft that will cater to this market.

Technical advancements in turboprop design have largely addressed concerns over noise levels, slower speeds, and cabin discomfort that were once associated with these aircraft. This progress has ensured that turboprops remain a viable and attractive option for regional air travel.

India could make strategic fleet selections from a range of modern turboprop offerings, optimized for profitability. These include Bombardier’s Dash 8-Q “Quiet” series and the CRJ, Embraer’s EMB 145, and the ATR 42/72. Contrary to popular perception, the modern turboprop is only five minutes slower per hour of flying over a 120-minute flight compared to jet aircraft.

Another compelling option is the Pilatus PC-12, a single-engine turboprop manufactured by Pilatus Aircraft. Known for its ruggedness, versatility, and ability to operate on smaller airstrips, the PC-12 has gained popularity in the business aviation, air ambulance, and regional transportation sectors. Its executive interior and cargo-carrying capabilities make it a versatile choice.

The Dash-8 Series

No discussion on the turboprop legacy is complete without recognizing the rich heritage of De Havilland and its iconic Dash-8 series. From the classic Moth to the ground breaking Comet, De Havilland’s aircraft have been milestones in aviation history. Although sold to Bombardier in 1992, the Dash 8 line-up continued its success under new ownership.

In 2019, when Longview acquired the program, they revived the storied De Havilland Canada brand name, underscoring the turboprop’s enduring relevance. With over 500 Dash 8 aircraft still in service globally, the new owners plan to restart Dash 8 production in 2033, driven by the belief that turboprops will become even more pertinent in the future aviation landscape.

The De Havilland Dash 8 series, including variants like the Q100, Q200, Q300, and Q400, has been a resounding success story. Specially designed for regional and short-haul operations, these versatile turboprops are renowned for their speed, range, and passenger comfort, making them a popular choice for regional airlines and specialized missions.

One of the key advantages of turboprop aircraft is their ability to operate from shorter runways and access a wider range of airfields, including unpaved and grass strips. This versatility makes them well-suited for operations in remote and undeveloped regions, such as parts of Africa, Southeast Asia, and other emerging markets, where traditional jet infrastructure may be limited.

As demand for regional and short-haul air travel continues to surge, particularly in emerging markets and developing regions, there will be ongoing opportunities for turboprop aircraft to provide essential air connectivity to underserved communities. This sentiment resonates strongly in the Indian subcontinent, where all major turboprop manufacturers have a vested interest.

Vaibhav Agrawal is a renowned journalist specializing in strategic affairs, geopolitics, aerospace and defence. This essay reflects his opinions alone

Member Login

Member Login