ONDC’s Struggle Could Chill Amazon & Flipkart’s Spines

ONDC aims to create a framework where both large and small players can coexist and compete based on quality, rates, and operations

by AIM India, AIM explain The Newest Technologies, And Their Commercial, Social And Political Impact

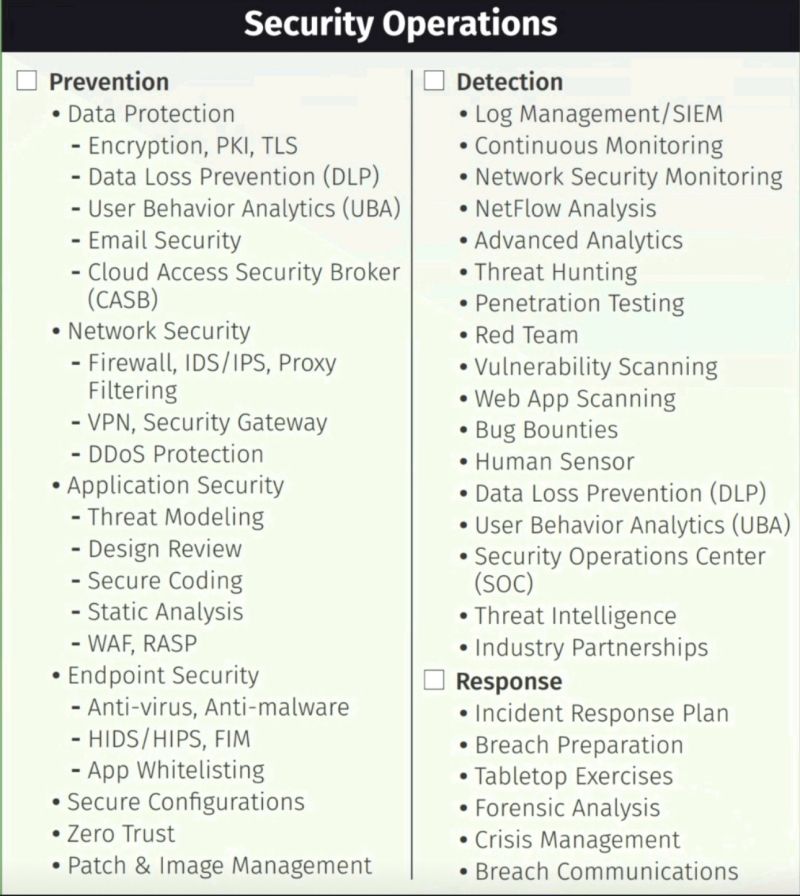

Last week, civil groups for internet liberties like IIF (internet freedom foundation) raised concerns about data protection on the ONDC platform in the absence of a data protection bill in the country.

At the risk of sounding clichéd, ONDC CTO Nitin Mishra told AIM, “ONDC does not participate in transactions in any form, so it does not own any data sensitive transactional data that is fundamentally between the buyer app and the seller app. They basically share this information, so the onus of protecting the data is on the respective apps.”

Powered by BeckN protocol, ONDC recently released a strategy paper which states that personal data and seller data will remain siloed within the buyer and seller apps, respectively.

However, there are concerns about how ONDC handles and stores consumer data without a data protection law. The company has provided clarification for the same through a set of business rules that they released. The platform clarified that Clause 7.2.1 of the platform requires network participants to obtain consent from data subjects before sharing their personal data with ONDC.

While ONDC has provided the purposes for which personal data may be requested, the specific fields cannot be determined in advance, they said. All the data collected, transferred, or received by ONDC from network participants will be securely stored in accordance with applicable laws. The Applicable Law referred to in this case is the Information Technology Act, 2000, and the rules specified therein, particularly the Information Technology (Reasonable security practices and procedures and sensitive personal data or information) Rules, 2011.

ONDC’s Struggles

The other major issue that ONDC currently faces is the slow onboarding on the platform, compared to something like UPI which took the electronic payment scene by storm.

Currently, ONDC boasts over 100,000 providers on the platform across 100+ cities, including taxi drivers, grocery sellers, and food and beverage sellers, according to Mishra. They are processing around 25,000 to 30,000 transactions per day and with strong government support, the platform aims to reach one lakh successful transactions per day and increase e-commerce penetration.

Mishra acknowledged that the onboarding process for ONDC has been slower compared to platforms like UPI. However he stressed that the adoption of UPI (Unified Payments Interface) itself took few years to reach its current level of success, with billions of transactions being processed monthly. The speed of adoption depends on how the ecosystem embraces the platform and how innovations are implemented to ensure seamless transactions.

Mishra emphasised the importance of innovation, particularly in logistics, as it is a major factor affecting the success of e-commerce. They are collaborating with India Post to establish a logistics network and are confident that with government support and their multi-pronged approach, they can reach the ambitious targets set for the next few years.

Despite the slower initial growth, he remains optimistic about the strong opportunity for ONDC and expects to see a significant scale-up of transactions in the coming months. While he wishes for faster progress, he believes that once the scale-up occurs, there will be a spike in activity and no turning back. The key is to achieve a critical mass of sellers and buyers, alongside creating apps for both the parties that lead to an explosion of orders.

No marketing, only word-of-mouth

Another major challenge is creating awareness among sellers and buyers about the marketplace created by ONDC protocols. However, Mishra believes there is always more that can be done in terms of marketing and visibility. He emphasised that while the ONDC platform facilitates the process, it is crucial for the integrated participants, such as applications and organisations, to conduct their own advertising and outreach activities.

Currently, there may be a slight lack of confidence among stakeholders regarding the scalability of ONDC, but as the platform has already demonstrated its functionality with 25,000 transactions in a day, Mishra is optimistic that more buyers and sellers will step forward to create awareness.

Overcoming these challenges will contribute to the acceptance and adaptability of ONDC.

Expanding to Tier 2 & Tier 3

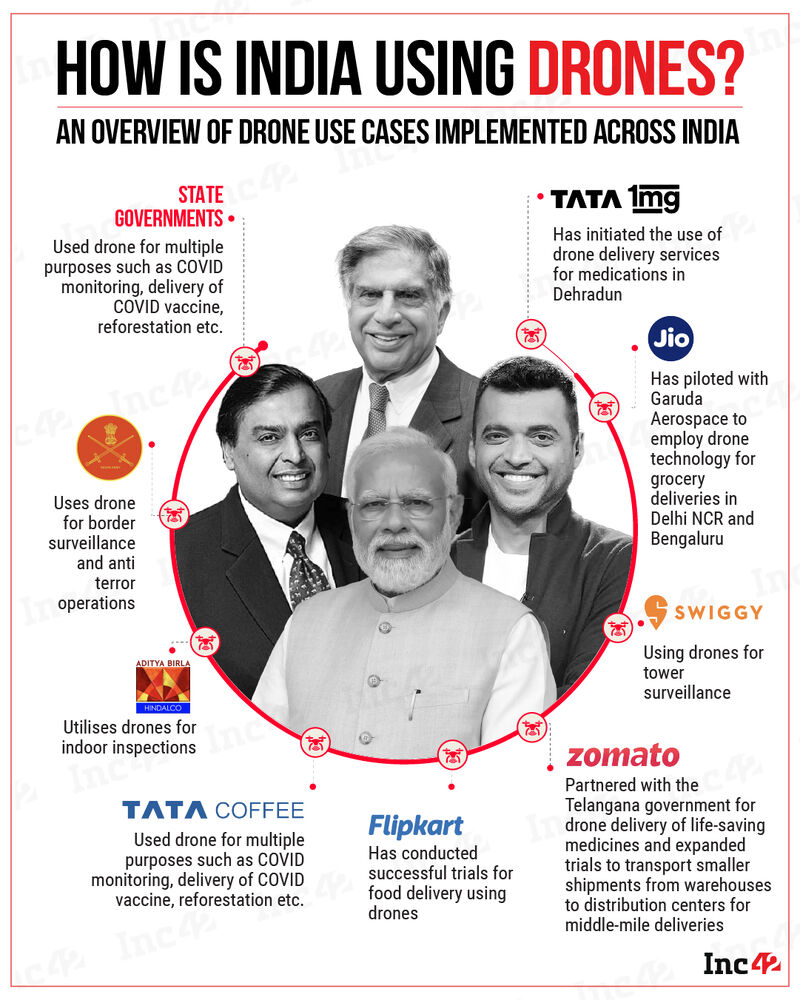

The target market for ONDC’s expansion includes Tier 2 and Tier 3 cities, as well as rural areas. The network is actively working with handicraft artisans and engaging with NGOs and financial organisations to provide support and technology solutions in the social sector which are digitally inexperienced. But, ONDC is not alone, existing e-commerce giants like Amazon and Flipkart are doing their part. Amazon has made its own efforts, while, Flipkart, with its Samarth initiative is looking to support artisans, weavers, and small businesses in the era of e-commerce.

One thing that sets ONDC apart in this already saturated e-commerce space is to democratise the e-commerce space and provide an equal playing field for all sellers. They aim to create multiple avenues for sellers to integrate into the platform, allowing them to avoid being solely dependent on one large player. This approach will benefit small sellers and encourage even large e-commerce players to eventually integrate with ONDC.

Moreover, ONDC is creating user-friendly platforms to facilitate visibility, sales, and service for these sellers. They are also collaborating with India Post, NGOs, and financial organisations to establish a logistics network and provide support for credit, finance, profitability, and selling products on the digital platform.

When asked if the government is looking to get into e-commerce, Mishra said he doesn’t have a concrete answer regarding the government’s plan to launch its own e-commerce platform based on ONDC. However, he believes that the government is supportive of initiatives to assist MSME players. While there may be reference applications available in the market, Mishra is unsure about the need for the government to create its own large app. He acknowledges the presence of technology powerhouses and continuous innovation in the country, which may render a government-led app unnecessary.

The network hopes to attract approximately 900 million buyers. They aim to provide multiple avenues for sellers to integrate and sell their products, allowing them to move away from dependency on large players. But ONDC is not averse to competing with large players like Amazon or Flipkart.

Mishra said, “I don’t think there is a need for ONDC to go out and attract buyers out of large platforms, because at some point in time, large platforms will also become the stakeholders, right? The large platforms will also integrate with ONDC, because they will see value in expanding their reach beyond these providers, which is on their own platform and service. Their customers have better options, better pricing, better strategies.”

Member Login

Member Login