Aditya Birla Group surpasses $100 billion in market capitalization, outperforms benchmark indices

source : Money Control, (Inputs from PTI)

Summary

UltraTech Cement, counted amongst the top cement manufacturers of the country, has a market

capitalisation of ₹2.95 lakh crore, accounting for nearly 35% of the overall m-cap of Aditya Birla Group.

Grasim is the second largest contributor, with m-cap of ₹1.68 lakh crore.

- Ofthe 12 listed entities of Aditya Birla Group,the surge in the overall m-cap was primarily powered by three firms – UltraTech Cement, Grasim and Hindalco

- UltraTech Cement, counted amongstthe top cement manufacturers ofthe country, has a market capitalisation of ₹2.95 lakh crore, accounting for nearly 35% ofthe overall m-cap of Aditya Birla Group. The company’s stock has grown by 34% in the last one year

- Grasim, whose m-cap has nearly doubled in the pastthree years, is the second biggest contributorin the growth of Aditya Birla Group’s market valuation. The m-cap ofthe company, also a cement manufacturer, stood at ₹1.68 lakh crore.

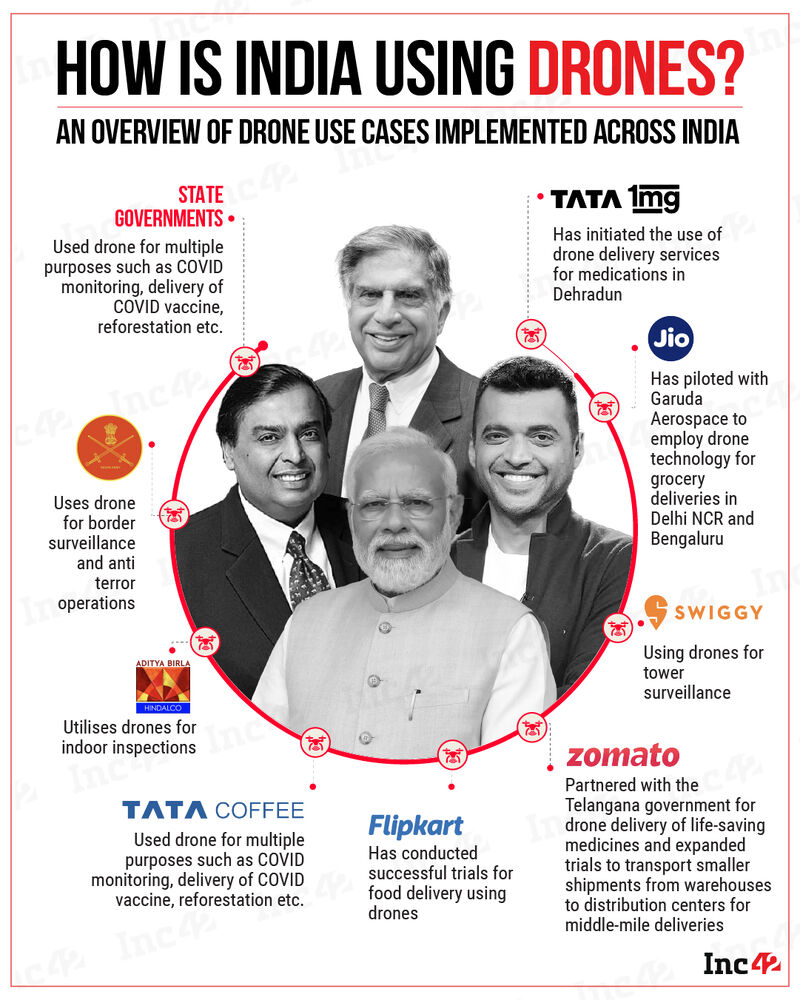

- The third major contributor behind the surge is Hindalco,the metals flagship of Aditya Birla Group. The aluminium manufacturer’s m-cap has doubled in less than two years, and currently stands at ₹1.5 lakh crore.

- Grasim has seen its market cap double to over USD 19 billion in the last 3 years on the back of incubating and scaling new high-growth engines,the statement said.

- “The group’s market cap growth has beaten the benchmark indices Sensex and Nifty, year-to-date, as well as on a one-year,three-year, and five-yeartime frame,” a statementfrom the group said.

- The combined market capitalization of Aditya Birla Group companies surpassed the $100 billion mark (Rs 8,51,460.25 crore) on Friday

- The group’s portfolio includes UltraTech Cement, Grasim, Hindalco, Aditya Birla Capital, Aditya Birla Sun Life AMC, Vodafone Idea, Aditya Birla Fashion and Retail, TCNS Clothing, Aditya Birla Money, Century Textiles, Century Enka, and Pilani Investment, collectively achieving a market valuation of Rs 8,51,460.25 crore on the BSE

- “The group’s market cap growth has outperformed benchmark indices Sensex and Nifty on a year-to-date basis, as well as over one-year,three-year, and five-year periods,” stated a release from the group. “In US dollarterms, ABG’s market cap growth has been double that ofthe S&P across one-year and three-yeartime frames,” it added.

- Grasim’s market cap has doubled to over $19 billion in the pastthree years, driven by the incubation and scaling of new high-growth ventures, according to the statement. Hindalco’s market cap has also doubled in less than two years, adding over $7 billion in the last12 months. Vodafone Idea’s market cap has nearly tripled in one year. Century Textiles, which encompasses the group’s real estate business, has also nearly tripled its market cap in the same period.

Member Login

Member Login